[ad_1]

KARACHI:

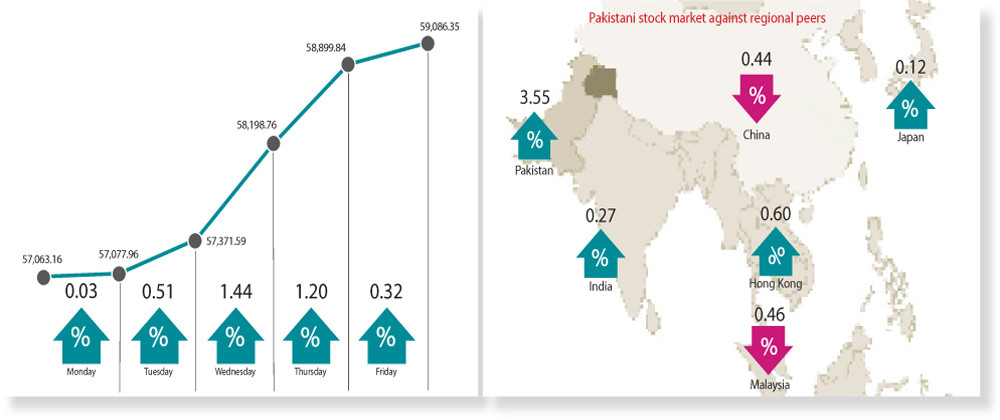

Pakistan Stock Exchange (PSX) maintained its upward march and broke records in the outgoing week when it climbed over 2,000 points as investors cheered reports of encouraging economic and earnings outlook and expected release of the second loan tranche of $700 million by the International Monetary Fund (IMF).

A key event was the easing of weekly inflation, measured by the Sensitive Price Indicator (SPI), by 0.06%, which boosted investors’ confidence. During the week, the KSE-100 index crossed the 59,000-point barrier for the first time in history and touched record highs.

Among worrying factors for investors was the rupee’s continuous topsy-turvy movement, shrinking foreign exchange reserves and gas tariff hike.

At the beginning of the week, the bourse closed with marginal gains amid a range-bound session as uncertainties surrounding the potential hike in industrial gas and power tariffs weighed on investors’ mind, though weaker global crude oil prices provided some support.

On Tuesday, the bourse made notable gains and closed near the all-time high, driven by upbeat data showing a 91% year-on-year (YoY) decline in the current account deficit in October 2023. The index touched a new record high on Wednesday as it rose past the 58,000-point mark on the back of continuous rupee recovery and a marked improvement in the current account balance that reached almost breakeven.

The PSX extended its record-breaking rally for the second consecutive day on Thursday where confidence grew among investors over a robust economic outlook. The KSE-100 index added around 700 points to its tally and reached the 58,900 mark. On the last day of the week, the market remained on its record-breaking spree for the third straight day, adding around 180 points and reaching a new peak above 59,000.

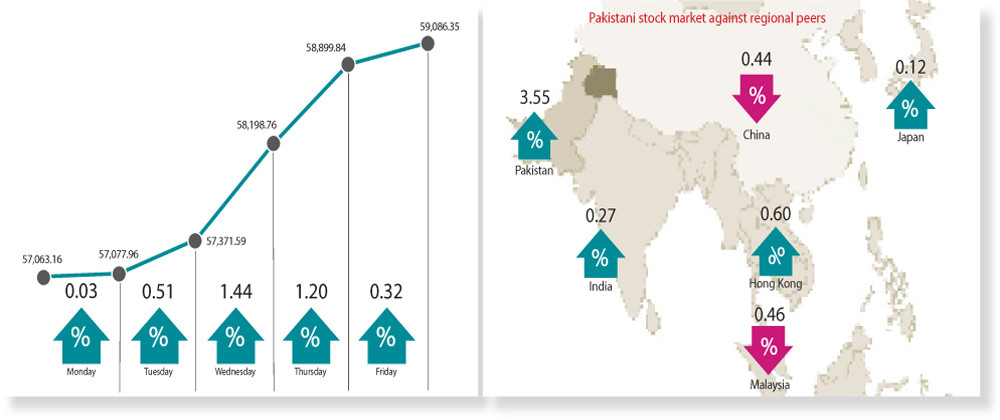

The benchmark KSE-100 index surged 2,023 points, or 3.5% week-on-week (WoW), and closed at 59,086 at the end of the week.

JS Global analyst Shagufta Irshad, in her review, wrote that the market continued its bull run, taking the index to a new high above 59,000 with gains of 3.5% WoW.

Read: In another record, PSX crosses 59k mark

Among major economic news, international oil prices remained volatile on production cut expectations while the Organisation of the Petroleum Exporting Countries (OPEC) meeting was delayed due to a dispute over output quotas.

The Federal Board of Revenue (FBR) released an SRO for the imposition of 40% tax on the windfall income from banks’ forex dealings during 2021 and 2022.

In other news, the current account hit almost breakeven for the second consecutive month, recording just $74 million deficit for October. Exports showed a 12% month-on-month (MoM) increase while imports were up 9% MoM.

Moreover, the State Bank’s forex reserves fell $217 million to $7.2 billion. Expectations of a further hike in gas prices to the tune of 10-15% to curb the circular debt buildup attracted some interest in energy sector stocks, the JS analyst said.

“The matter of revision in pharmaceutical product prices was deferred by the Economic Coordination Committee (ECC) due to inadequate supporting analysis from the Ministry of National Health Services.”

In its comments, Arif Habib Limited (AHL) said that the market maintained its bullish run and reached a new high above 59,000 points. It attributed the upward trend to a 91% YoY decrease in the current account deficit for October 2023. In the month, textile exports registered some growth after 13 months, up 6% YoY. Pakistani rupee closed at 285.37 against the greenback, appreciating Rs1.12, or 0.39% WoW, it said.

Sector-wise positive contributors were commercial banks (960 points), fertiliser (247 points), technology and communication (182 points), glass and ceramics (89 points) and miscellaneous (89 points).

In terms of individual stocks, positive contribution came from Meezan Bank (221 points), Bank AL Habib (145 points), Systems Limited (135 points), Fauji Fertiliser Company (114 points) and Mari Petroleum (99 points). Foreigners’ buying continued during the week under review, which came in at $8.5 million compared to net buying of $6.3 million last week, AHL added.

Published in The Express Tribune, November 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

[ad_2]

Source link