[ad_1]

Pakistan’s power sector woes are a hot topic, often attributed to capacity charges as the primary cause of circular debt and high electricity costs. However, the reality is far more complex.

The public’s lack of exposure to the true causes makes it challenging to convey the consequences of our cumulative failures in power sector policies, governance, and accountability.

The result is continually rising electricity prices, escalating circular debt, and a failing transmission and distribution system.

The high cost of electricity

Exorbitant electricity charges for both commercial and domestic consumers have rendered Pakistan’s industrial sector unviable and tested the patience of households.

Various analysts blame political actors selectively, but few address the root cause of this crisis: the shift in the national power generation mix from a hydel/renewable-dominated system to one reliant on imported fuel-based thermal power generation.

The misguided shift

Pakistan is blessed with the Indus River Basin, a natural hydrological resource. Instead of harnessing its potential through storage reservoirs and run-of-the-river power projects, we politicised hydel projects and favoured thermal power plants. This strategic direction ignored the implications for an oil and gas-importing country.

Facing a rapidly increasing demand, political governments, limited by their electoral terms, opted for Independent Power Producers (IPPs) to invest in thermal projects that could be completed quickly.

Bureaucratic and political collusion resulted in rigged contracts with guaranteed profits and capacity payments in a “Take or Pay” mode, backed by sovereign guarantees and international arbitration.

Power generation mix and IPPs

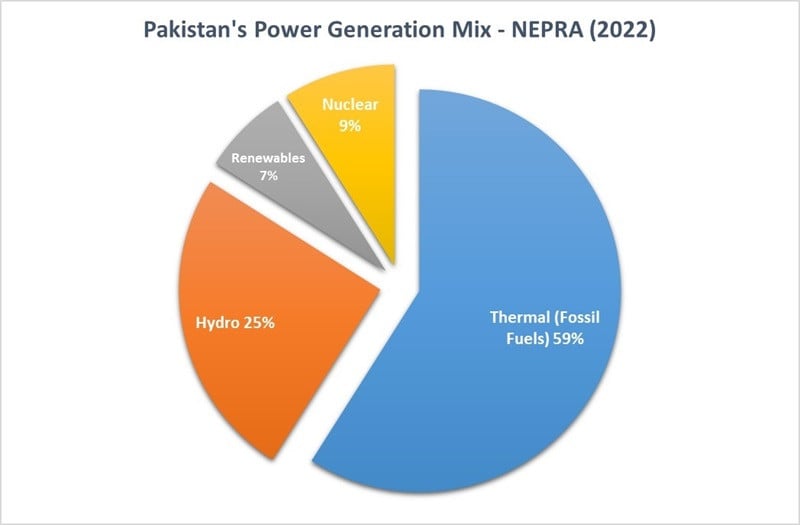

According to NEPRA’s 2002 report, Pakistan’s total installed capacity was 43,775 megawatts, with 59% thermal, 25% hydro, 7% renewable, and 9% nuclear.

IPPs, accounting for 30% of national power generation, are entirely thermal. The miscalculation of industrial consumption targets led to an overestimation of demand, contributing to the current excess capacity.

The decline of WAPDA

Pakistan’s power sector woes began with the gradual decline of WAPDA (Water and Power Development Authority) due to multiple factors such as high debt-based expansion, costly expansions without federal grants, high operational expenses, compulsions for subsidised rates, and inefficient private power projects. The introduction of the Private Sector Power Generation Policy in 1994 marked the beginning of the IPPs era.

This policy was formulated in an environment lacking a regulatory authority like NEPRA (National Electric Power Regulatory Authority), resulting in several loopholes, including payments to IPPs in dollar terms, that favoured investors at the expense of the national interest. The “Take or Pay” clause in the policy ensured capacity payments for IPPs, guaranteeing their revenue regardless of actual electricity demand.

IPPs based on Residual Fuel Oil (RFO) and natural gas faced different challenges. RFO-based IPPs had storage requirements, while gas-based IPPs depended on the availability of natural gas, with turbines operating at approximately 30% efficiency. RFO-based IPPs, being closer to the main electricity grid, gained an unfair advantage in the evacuation of electricity over the more economically efficient gas-based IPPs.

The fundamental flaw of the 1994 policy was the high cost of generation for RFO-based plants and the dependency on natural gas availability for gas-based IPPs. These issues led to significant inefficiencies and higher costs in the power sector, contributing to the ongoing crisis.

Transmission and distribution failures

One of the most significant failures of power sector planners was the lack of development of a robust and efficient transmission and distribution (T&D) system. This neglect led to two serious problems over time. Firstly, there was an inability to evacuate power from all the Independent Power Producers (IPPs) due to grid capacity constraints. Secondly, there were substantial technical losses. Outdated equipment caused heat losses through the “Joule Effect,” and combined with other leakages, resulted in 2.4% transmission losses in 2023 alone.

To grasp the extent of T&D losses, one can refer to NEPRA’s FY 2022-23 report. It shows that the actual T&D losses were 16.38%, significantly higher than the weighted average of 12.21% allowed in the tariff. The Distribution Companies (DISCOs) with the highest losses were Peshawar, Quetta, Hyderabad, and Sukkur.

Evolving power policies

Under the same challenging environment, Pakistan’s power sector journey continued without clear direction, avoiding the construction of ideally-sited mega dams like Kalabagh due to political considerations. A new power policy was introduced in 2002, which improved upon the 1994 policy by establishing regulators like NEPRA and gaining valuable experience in IPP management. Under this policy, 13 IPPs were given licences with cost-plus tariffs, where regulators calculated the entire cost before setting tariffs. However, the “Take or Pay” problem persisted, with returns kept at 15%. During Prime Minister Shaukat Aziz’s tenure, the Economic Coordination Committee (ECC) made a significant decision to pay the Return on Equity (ROE) in dollars to all IPPs, which had far-reaching consequences.

In 2013, another power policy was introduced, focusing on coal-fired IPPs. While the policy emphasised efficient equipment and environmental considerations, it failed to utilise indigenous resources and relied on imported coal. The location of coal plants, such as the Sahiwal coal power plant, faced criticism for logistical and environmental reasons due to this reliance. Despite the introduction of coal, there was no focus on grid improvements, the use of indigenous Thar coal, or the modification of the “Take or Pay” clause. During this period, no mega hydel dams were initiated to tap the cheapest natural resource available to Pakistan.

The 2015 power policy focused on renewable energy (wind, solar, and biomass). To attract investment in wind projects, favourable feed-in tariffs and upfront tariffs were granted, retaining the same “Take or Pay” clauses. Although reliance on imported fuel was reduced with more efficient turbines and natural resources, grid development and T&D loss issues were not addressed. Consequently, power curtailment due to grid constraints resulted in idle capacity and suboptimal utilisation of wind power plants.

Throughout these policy changes, future energy demand forecasts relied on the “Indicative Generation Capacity Enhancement Plan,” which projected optimistic GDP growth, historical trends, and consumption patterns using regression models. These forecasts proved inaccurate due to low GDP growth, lack of industrial development, and asymmetrical consumption cycles.

The financial burden

In simple terms, the excess capacity created through IPPs, which had to be paid in dollar terms despite a lack of electricity dispatch due to grid and low demand issues, has severely impacted Pakistan.

This, coupled with theft and distribution losses, and the high cost of generation borne by the state, has resulted in mounting circular debt.

Circular debt has become an albatross around the neck of Pakistan’s power sector, threatening to sink the economy.

Capacity payments alone have reached Rs 2 trillion by 2024 and are expected to rise to Rs 2.8 trillion by the end of the year.

According to a report by the Committee for Power Sector Audit, Circular Debt Resolution, and Future Road Map, headed by Mr Muhammad Ali in March 2020, Pakistan had the highest power tariff in South Asia.

The report provides the following comparative figures:

|

Countries |

Residential (cents/kWh) |

Commercial (cents/kWh) |

Industrial (cents/kWh) |

|

Pakistan |

1.3-15.4 |

12.4-15.9 |

11.8-12.5 |

|

India |

4.2-11.2 |

8.4-11.9 |

10.9 |

|

Bangladesh |

4.2-12.6 |

10.8 |

6.8 |

Currently, the industrial tariff in Pakistan is around Rs 35/kWh. Under such high rates, the dream of industrialisation in Pakistan remains unattainable.

In 2020, a Power Sector Review recommended several measures and reforms, including the revision of Returns on Investment (ROIs) and a forensic audit to determine excess profits earned by IPPs through misreporting heat rates, fuel consumption, and O&M costs.

The IPPs were pressured by a civil-military consensus, with a premier intelligence agency playing a crucial role, leading to an MOU for renegotiation of the Power Purchase Agreements (PPAs).

The renegotiation included reducing ROIs from 15% to 12% and a forensic audit by NEPRA to establish excess profits that would be deposited in the government treasury.

Unfortunately, some influential IPP members persuaded the government to change the MOU requirement from a forensic audit by the regulator to an arbitrator.

This change essentially killed any prospects of a proper investigation into malpractices and excess profit determination. NEPRA, having the necessary data and expertise, was bypassed in favour of arbitrators like retired judges who lacked the expertise to expose technical malpractices.

Thus, the 2020 renegotiation exercise yielded limited results, with only a reduction in ROIs, leaving excess profits from upfront project costs, O&M, and efficiency gains in heat rates unresolved.

According to the same 2020 report, the profitability of IPPs in Pakistan was high due to lucrative contracts with “Take or Pay” clauses and attractive ROIs (Internal Rate of Return – IRRs).

The following table from the report shows IRR percentages for different types of IPPs:

|

Technology |

IRR in US dollars |

|

Thermal |

|

|

Imported Coal |

17.00% |

|

RLNG |

16.00% |

|

Local Natural Gas |

15.00% |

|

Thar Coal |

20.00% |

|

Bagasse |

17.00% |

|

Renewable |

|

|

Solar/Wind |

17.00-18.00% |

|

Hydro |

17.00% |

The report disclosed that the 16 IPPs established under the 1994 policy invested Rs 51.80 billion but earned Rs 415 billion in profits, including dividends of over Rs 310 billion.

Investments were recovered within 3-4 years, and dividends earned were 22 times the initial investment. Subsequently, 13 RFO and gas-based IPPs established under the 2002 policy earned Rs 203 billion against an investment of Rs 57.8 billion by 2020.

Under the 2015 policy, two imported coal-based plants recovered the bulk of their investment within two years, with one recovering 71% of the investment after two years and the other 32% after one year.

Currency devaluation further benefits IPPs, as the IRR of 17% for imported coal-based plants translates to a US dollar Return on Equity (ROE) of 27% (as of 2020).

The report concluded that for IPPs established under the 2002 policy, excess payments by NEPRA totalled Rs 64.22 billion in nine years prior to 2020.

If future excess payments based on the remaining life of these IPPs are included, the total amount would rise to Rs 209.46 billion. These excess payments resulted from misreported efficiency gains and O&M expenditures.

Similar issues were found in the 24 wind-based IPPs and seven solar-based IPPs under the 2006 policy, where investment recovery was based on a minimum benchmark and excess generation should have been shared but was not.

Excess profits were generated due to faulty IRR calculations by NEPRA, errors in debt and interest tenors, inventory management, and neglect in adjusting US dollar-based returns allowed by the ECC in 2002. Previously, the energy purchase component (EPP) of electricity prices was higher, but now the capacity payment component (CPP) has overtaken the EPP.

The continual rise in the CPP component is due to reliance on imported fuel, forced evacuation of expensive RFO-based IPPs, and high LIBOR/KIBOR spreads on debt.

Need for comprehensive reforms

The solution to Pakistan’s power sector problems requires a holistic view and integrated planning to reduce power costs and circular debt.

On the generation side, it is crucial to renegotiate Power Purchase Agreements (PPAs) with IPPs that have a useful life and efficient equipment.

This renegotiation should be based on a forensic audit by the regulator to determine excess profits earned.

Old and inefficient plants should be retired upon contract completion, and existing PPAs should be renegotiated, including extending debt tenors.

Special efforts should be made to terminate contracts with diesel and RFO-based IPPs.

T&D losses need to be significantly reduced. Transmission losses should be brought down from 2-3% to 1%, and distribution losses from 15% to 5%.

This can be achieved through an overhaul of transmission lines and better control of theft at the distribution level.

Tackling theft losses is a governance issue that requires government intervention, supported by intelligence and law enforcement agencies.

Power curtailment issues for renewable energy sources like wind and solar, caused by grid constraints, should be resolved through battery and pump storage solutions.

Additionally, dollarized returns need to be delinked, and separate dollar rates should be established for each power policy.

A forensic audit of all upfront tariff IPPs should be conducted, and tariffs should be adjusted based on the findings.

Shifting all imported coal-based plants to Thar coal and connecting the mine-mouth sites to the main rail network of the country should be prioritised.

Furthermore, privatising DISCOs and transitioning the power sector from a single buyer’s market to a competitive multi-buyer market will foster efficiency and competitiveness.

Reviving hydel projects like the Kalabagh Dam and increasing the share of hydel power in the national generation mix to 60% is essential.

Addressing the power of IPP lobbies and the weaknesses of regulators is crucial.

NEPRA must perform its oversight and scrutiny role effectively to prevent IPPs from accumulating excess profits through efficiency gains, upfront tariffs, and inflated O&M costs.

Integrated planning and governance reforms are vital to tackle the root causes of the crisis.

This includes addressing personal interests within the power bureaucracy and their political patrons, improving regulatory competence, and fully utilising indigenous hydel, solar, and wind resources.

In conclusion, the capacity payments issue is a symptom of deeper systemic problems in Pakistan’s power sector.

A multipronged and integrated reform approach is essential to address the multidimensional challenges.

By taking these steps, Pakistan can create a more sustainable, efficient, and cost-effective power sector, ultimately benefiting both the economy and the public.

[ad_2]

Source link